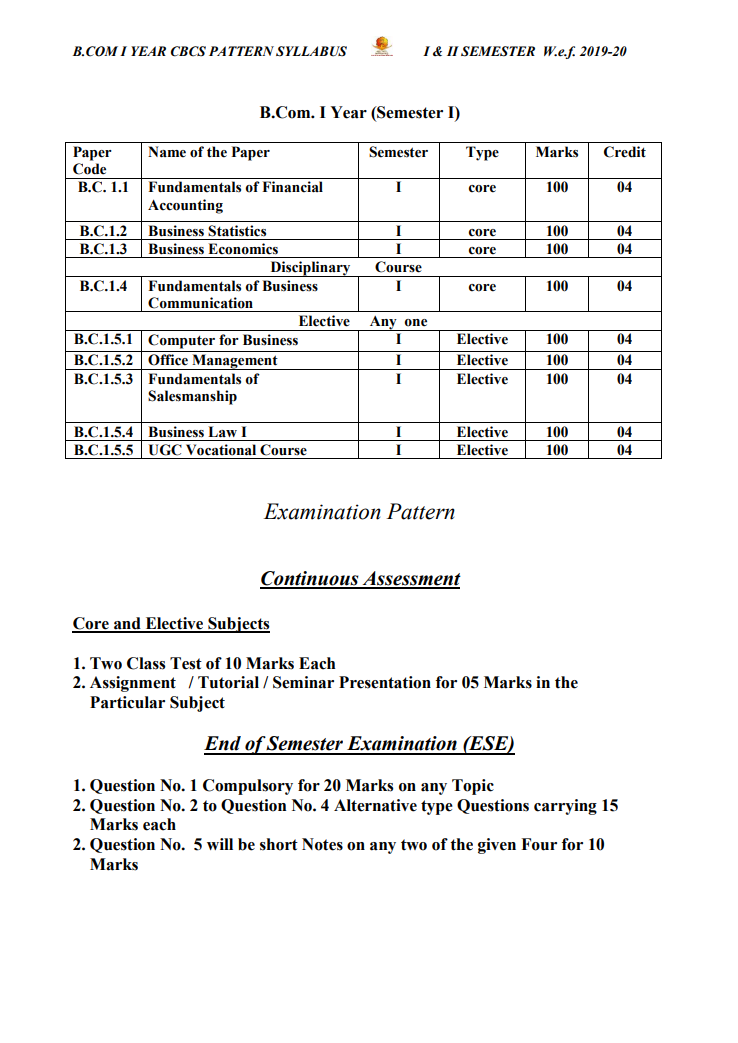

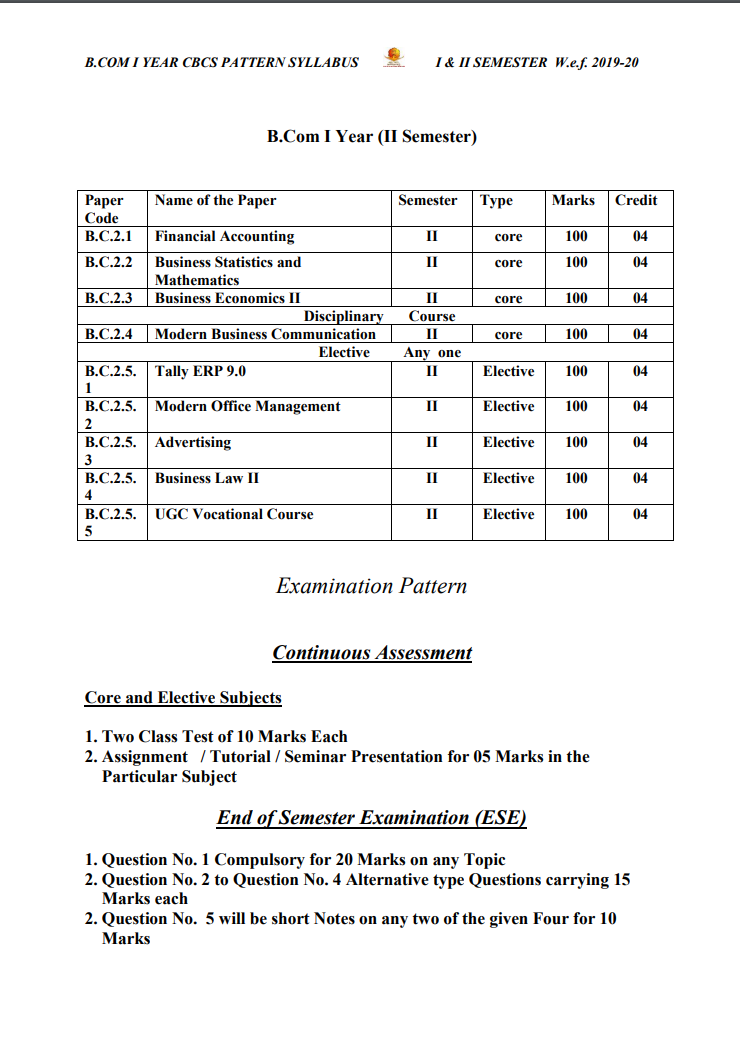

Commerce

Commerce Overview

Level :- Undergraduate

Intake :- 60 Seats

Assessment Pattern :- Semester

Starting :- June 2023

Study Mode :- Regular Full Time (3 Years)

Eligibility

Outcomes

Opportunities

you can apply for following job

Eligibility

Any one of the following Criteria should be fulfilled to seek admission in B. Com course.

- Higher Secondary School Certificate (10+2) or its equivalent Examination with English.

- Three Years Diploma Course after S.S.C. i.e., 10th standard, of Board of Technical Education conducted by Government of Maharashtra or its equivalent.

- Two Years Diploma in Pharmacy after HSC, of Board of Technical Education conducted by Government of Maharashtra or its equivalent.

- MCVC

Outcomes

Students learn about the more advanced ideas in the field of commerce in the B.com course.

- The course aids in developing leaders, managers, and professionals by equipping students with the information, abilities, and attitudes needed to manage training, trade, and industry.

- It meets the expanding needs of business society and helps students achieve enterprise-level excellence by ensuring that they are well-versed in accounting, management, economics, and other related concepts, as well as by offering advanced expertise in cost accounting and marketing management.

- Foster students’ intellectual, interpersonal, societal, and personal growth with a focus on holistic education to increase employability.

Opportunities

Pursuing Professional courses simultaneously

- CA, CMA, CS

- MPSC, UPSC, Competitive Exam

- Computer Courses

- Foreign languages

- Any other short-term courses

- Banking – The government sector offers a wide range of job opportunities including the chance to work as an official in a government bank or in the finance, accounting, or management division of a business. After obtaining a B. Com. degree. The candidate has the finest employment potential if they are serious about building or entering the government sector

- Finance – Just possessing a bachelor’s degree, such as a B. Com, won’t get you a stable job in today’s dynamic and ever-changing employment market. To compete in today’s tough job market, students need more than just a BCom degree. They need accurate information and additional skills. We’ll talk about how you can pursue your desire to work in the finance industry after earning your BCom. Finance is an exciting industry to work in.

- Accounting- The scope of a BCom. in accounting after graduation is broad. The potential for the field is excellent, and graduates are being hired by reputable firms with competitive compensation packages because commerce, finance, and other related fields are now recognized as a universal language on a global scale. As a result, there is a wide range of employment opportunities after BCom. Accountancy graduates. Graduates typically make roughly INR 4.78 LPA in income.

- Insurance- Due to the existence of numerous insurance businesses in the market that provides a variety of life and non-life insurance products, BCom Insurance Management is becoming increasingly well-liked among students. After finishing this course, candidates may work for audit firms in tax-related problems, banks, financial institutions, or insurance companies.

- Taxation- B.Com. in Taxation graduates have a variety of BCom career options, including chartered accountants, financial risk managers, tax consultants, tax specialists, senior tax managers, tax compliance managers, cost estimators, lecturers, stockbrokers, financial analysts, and actuaries. Graduates can also find employment in the public and private sectors. Freshmen in BCom. Taxation can expect to earn an average of INR 2 to 4.5 LPA (PayScale), with experience and skill levels rising over time

- Education – After B. Com, you can choose to do the relatively straightforward yet useful B.Ed. course. You can use the knowledge you have gained as a B.com graduate in your career as a lecturer.

- Wealth Management – We are searching for a wealth manager who will oversee providing clients with financial services and guidance to help them with their financial endeavors. Relationship management, assisting clients with account information, and giving recommendations on financial investments are all duties of wealth managers.

- Master of Commerce – Masters in Commerce, or M.Com, is one of the most popular courses available after BCom. You can learn more in-depth information on topics like accounting, taxation, business studies, statistics, economics, finance, international business, etc. in this course. You can select a specialization from among business-related courses like MComs in the areas of finance, accounting, economics, taxation, business studies, marketing, management, and statistics .

- Master of Business Administration – You can choose to specialize in finance in your Master of Business Administration (MBA) if you want to work in the finance industry. You can work at managerial levels in finance, BFSI, FMCG, IT, consulting, and top companies after earning an MBA in finance. Following an MBA in finance, the best career options after BCom include those as a finance manager, consultant, financial analyst, credit risk manager, portfolio manager, and treasurer.

- Chartered Accountancy – One of the top career options for graduates of commerce programs is chartered accounting (CA). Accounting, auditing, taxation, and financial assessment for an individual or organization are all included in the practice of chartered accounting. Candidates who successfully finish the CA course are awarded professional certification by the Institute of Chartered Accountants of India (ICAI), which enables them to engage in professional practice .

- Company Secretary – Company secretary is a popular career option that requires a professional degree after receiving a BCom. The Indian company secretary profession is governed by the Institute of Company Secretaries of India (ICSI). A company secretary manages tax returns, legal and statutory obligations, record-keeping, giving advice to the board of directors, and making sure the firm complies as part of their job description.

- Chartered Financial Analyst – The Chartered Financial Analyst (CFA) credential is a well-liked option among business professionals. The CFA Institute overlooks the CFA programme (formerly the Association for Investment Management and Research). The applicants must pass three levels of tests that examine their knowledge of accounting, economics, business ethics, money management, and security analysis. Candidates are certified as financial analysts and qualified to practice professionally after passing all three levels.

- Business Accounting and Taxation – You’ll gain the theoretical and practical knowledge of accounting and taxation you need from this brief professional course to be ready for the workplace. The training curriculum includes topics on Goods and Service Tax (GST), Direct Taxation, Payroll, Financial Reporting, Tally, Excel for Accounting & MIS, Finalization of Financial Statements, Busy Software, and SAP.

- Certified Management Account – The Institute of Management Accountants offers this course as a certification, preparing the student for a wide range of positions in financial accounting and strategic management. A two-part exam covering decisions relating to external financial reporting, planning, budgeting, and forecasting, performance management, cost management, internal controls, technology, and analytics, financial statement analysis, corporate finance, decision analysis, risk management, investment decisions, and professional ethics is included in the course schedule.

- Certified Public Accounting – The CPA is a well-known professional certification programme that focuses on financial planning, attestation services, and audits of financial statements. To protect the client’s financial health, a certified public accountant (CPA) is legally permitted to provide financial advice and audit services. Professionals who pass the exam covering Regulation, Financial Accounting and Reporting, Business Environment and Concepts, and Auditing and Attestation are awarded CPA certification by the American Institute of Certified Public Accountants.

- Financial Risk Management – In the financial markets, FRM is a recognized profession on a global scale. The Global Association of Risk Professionals offers accreditation to professionals in the financial risk management sector (GARP). To become FRM certified, professionals with at least two years of work experience in financial risk management must pass a two-part exam.

- Certified Financial Planner – Another well-known professional title in the financial planning sector is the Certified Financial Planner designation (CFP). The Certified Financial Planner (CFP) designation, awarded by the Certified Financial Planner Board of Standards, Inc., is one of the most difficult financial counselling programmes. A demanding exam is part of the certification procedure to assess aptitude and moral character. A CFA is qualified to provide guidance on tax, investment, retirement, insurance, and educational planning.

- Digital Marketing – After B.Com, it would be a promising idea to enroll in a digital marketing school because it is one of the trendiest sectors right now. After B. Com, one of the top courses in digital marketing. You can find fascinating opportunities with a sizable annual package in this trending sector with dynamic work roles. A digital marketing course’s main goal is to educate you in the field of digital marketing, along with its fundamental ideas and methods for creating a trustworthy brand online. SEO, SEM, SMM, email marketing, content marketing, PPC, web design, and other topics are covered in-depth in digital marketing courses. 3 to 11 months are the possible course lengths. One of the greatest courses for B.Com students, but also for other students, is digital marketing.

you can apply for following job

(for high salary and upper designation need to complete master degree )

- Accountant

- Cost Accountant

- Sales Manager

- Entrepreneur

- Researcher

- Business Development Executive

- Business Associates

- Regulatory Compliance Officer

- Retail Associates

- Marketing Manager

- Relationship Executive

- Portfolio Manager

- Quantitative Analyst

- Risk analyst

- Business Correspondent

- Customer Service Executive

- Sales Executive

- Financial modelling

- Digital Marketer

- Bank professional

- Insurance advisor

- Tax advisory

- Financial consultant

- Investment consultant

- Financial analyst

- Trader/Equity dealers